20+ Ltv ratio calculator

35000 020 175000. The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility.

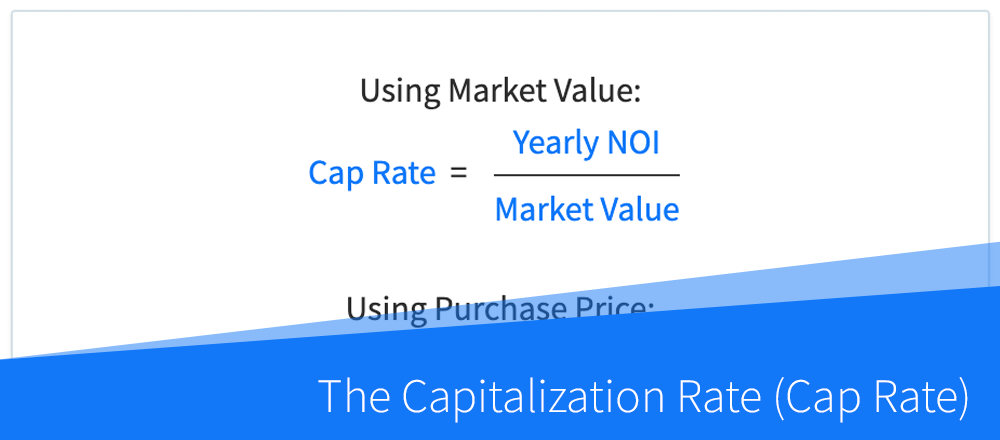

Dealcheck Blog Dealcheck

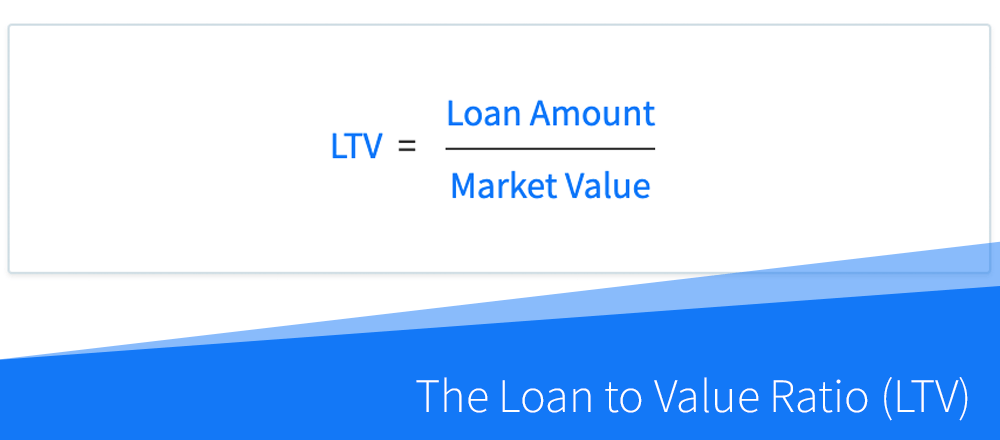

LTV Loan Amount Property Value Where LTV is the loan to value ratio LA is the original loan amount PV is the property value.

. An LTV over 100 means you owe more on the loan than. Using Excel to Calculate the Loan-to-Value LTV Ratio To calculate your LTV ratio using Microsoft Excel for the example above first right click on columns A B and C select. Loan Amount Value of the Home After you have entered this.

Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. Find the loan to value ratio LTV. So your combined loan-to-value equation would look like this.

The LTV is the ratio of how much you owe on your current home loan divided by the value of your home. To calculate LTV you would divide the mortgage amount over the property value. Our Loan to Value LTV Calculator is easy to use.

To figure out your LTV ratio divide your current loan balance you can find this number. The Loan to Value Calculator uses the following formulas. Anything in the 80 to 90 range or lower and youre golden.

That means your LTV is 80 percent and your deposit is. LTV Ratio Mortgage Amount Home Value For example if. The mortgage amount is divided by the home value to determine the LTV ratio.

Enter your estimated home value. The following formula is used. The loan-to-value ratio commonly referred to as LTV is a comparison of your cars value to how much you owe on the loan.

An 80 LTV ratio requires you to put 20 down so that 35000 needs to be 20 of the total cost of the home. You need to divide 200000 by 250000 to find out what your LTV is. This is equal to 08 which is 80 when multiplied by 100.

LTVCAC Ratio Formula LTVCAC Ratio Lifetime Value. You only have to enter two components to learn your loan to value. Our Loan to Value LTV Calculator is easy to use.

Home price x 020 35000. Thats why your lender often will require an on-site appraisal as part of the process for obtaining a loan. For example if you buy a home appraised at.

This gives you an LTV of 80 so you should look for mortgage deals that are available up to 80 LTV. If youre in the 90-97 range its still a doable loan youll just want to. Your home currently appraises for 200000.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Your loan-to-value ratio will be instantly calculated. For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90.

Then multiply by 100 to. This indicator can be found by dividing the loan amount borrowed by the property price. Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine. If you are purchasing a home the property value would be the purchasing price of the home while the. LTV Ratio Formula Loan amountPropertys market value 100 For example suppose a property is valued at Rs25 Crore and you are eligible for a loan amount of Rs175 Crore.

This is a very significant figure the lenders take account of. It also will be important to determine the terms APR and other factors of the loan. Loan-to-value becomes a key.

If you put 20 down on a 200000 home that 40000 payment would mean the. 165000 200000 825 Convert 825 to a percentage and that gives you a. For example if you have a mortgage of 150000 on a house thats worth 200000 you have a loan-to-value of 75 therefore you have 50000 as equity.

To find out your LTV simply divide 200000 by 250000 and then multiply by 100. To calculate your LTV ratio take your mortgage amount and divide it by the purchase price or appraised value of the home whichever is lower. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value.

The formula used to compute the LTVCAC ratio is the customer lifetime value LTV divided by the customer acquisition cost CAC. An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property expressed as a percentage. Loan to Value LTV Ratio 320000 400000 LTV.

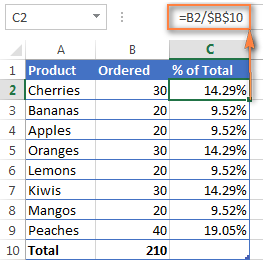

How To Calculate Percentage In Excel Percent Formula Examples

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Predictive Ltv

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Customer Lifetime Value An Ultimate Guide

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Loan To Value Ratio Ltv Formula And Example Calculation

Everything About Debt To Income Ratio And How To Calculate It

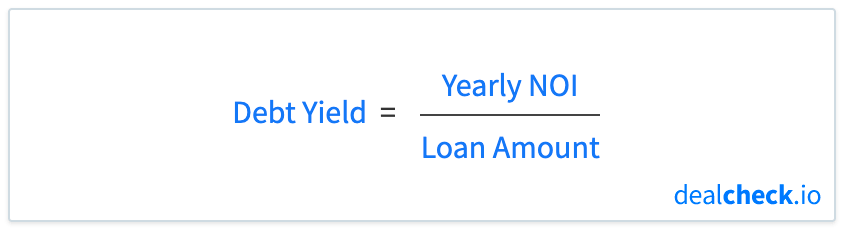

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Loan To Value Ratio Ltv Formula And Example Calculation

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

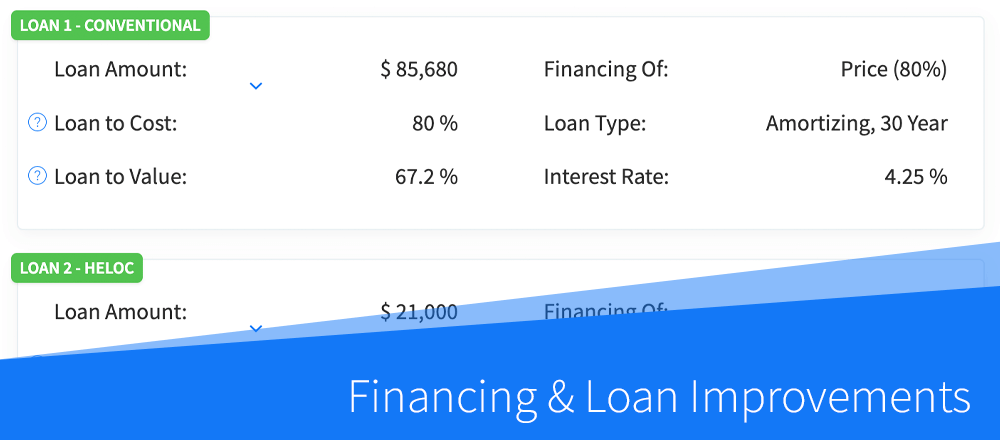

Dealcheck Blog Dealcheck

Calculate The Loan To Value Ltv Ratio Using Excel

Dealcheck Blog Dealcheck

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog